Divergence trading what if there was a low risk way to sell near the top or buy near the bottom of a trend?. When the price’s fast moving average is over the slow moving average, and the oscillator’s fast moving average is under the slow moving average, there is a divergence.

MACD Divergence Trading System FREE Download! Forex

Rsi divergence is a difference between a fast and a slow rsi.

Divergence trading system. Submit by nicolas 14/10/2012 time frame 15 min or higher. Dow noticed that when the dow jones industrials made new highs, the dow transportation index tends to make new highs as well and when the industrials index made new lows, the transportation index would. Hi forex wiki trading divergence trading system:

In a sample backtest for 16 years, it shows 100% success rate for nse nifty. That takes a profitable trading system, great psychological discipline, and impeccable money management. In the world of forex trading, divergence is simply where the price of a particular currency pair is making new highs, but a relevant technical indicator is failing to make new highs (and starting to move lower), or where a forex pair is making new lows, but a technical indicator is failing to make new lows (and starting to move higher).

Divergence trading is an awesome tool to have in your toolbox because divergences signal to you that something fishy is going on and that you should pay closer attention. I want to propose to you a trading system that i have used practically my entire life as a trader. If you can get the more traditional macd indicator you can trade divergence from the histogram and the macd lines waving.

A divergence is one of the most important concepts for finding trend reversals. It is not a system that i have invented, this has been used for a long time in trading (speculation), Divergence in stock trading is a powerful reversal signal, as it can identify the start of a new trend.

Yes stoch 8,3,3 works well for divergence. Why divergence systems work so well. Divergence is a great way to regularly make money, if you can get divergence in more than 1 time frame even better.

Good luck with your trading. 16 / 100 powered by rank math seo. Posted on august 8, 2020 august 8, 2020 by fxl fxl.

Forex divergence trading is both a concept and a trading strategy that is found in almost all markets. How to trade rsi divergence with an automatic trading system our little tip for you is to apply two moving average (10 and 20 periods) to rsi and price. When i started trading, the main struggle as traders is to exactly pinpoint the market entry in order to catch the next big move.

Today, in this article we would discuss about the divergence trading strategies … Default values are 5 for the fast one and 14 for the slow one. Successful trading is the act making better trading decisions than about 95% of other traders.

When rsi divergence cross zero line from. This system can be used to make trades that you will hold for a day or two with the hourly charts. By using this approach, we’ll reduce the market noise and eliminate false signals.

Sometimes you can even use it as a signal for a trend to continue! Fx5 divergence trading system, this is a forex strategy based on the divergence trading method. This system has unbelievable profit potential.

Learning divergence trading strategy for the macd, stochastic, or rsi might just give you the edge you need over typical losing traders. 1) zig zag with depth 50 2) rsi interval 140 Trix divergence signal arrow buy, the entry point is when the ergodic crosses zero and candles are green

Advanced trading systems collection 2 this system will cover the macd divergence. There are two types of divergence in stock trading: With this trading system you can trade any currency pair (i suggest eur/usd and gbd/usd when you start), and you will always trade with 1 hour or longer term charts.

So what we gonna want with this technique two indicator. Market divergence but we™ll not be covering these types of divergences in this book so as they will not be using in our trading system. Price action has a different important in forex trading market, this market has a great usage of trend system and in it divergence day trading plays a great role.

Location is a universal concept in trading and regardless of your trading system, adding the filter of location can usually always enhance the quality of your signals and trades. Divergence is an indication that an end to the current trend may be near occurs when the price of a security diverges from a value of a technical. Also divergences are divided by bullish and bearish ones.

Buy when rsi shows a positive divergence with strong momentum. Since the market goes up in price swings, a decrease in momentum is a sign of reversal of uptrend. The best “hidden divergence” trend following strategy (forex & stock trading system) if you’re a trend trader and prefer the swing trading , i’m sure that you face the same problems i was facing.

Selecting indicators for divergence trading system. Divergence is created when the price action contradicts with the movement of an indicator. For example, if bulls have steadily pushed eur/usd higher, the appearance of divergence between price and indicator could mean that bulls are.

Positive divergence is a analysis tool that constructs profitability trade which protects from loss. The technique relies on divergence in numerous method. Divergences are used by traders in an attempt to determine if a trend is getting weaker, which may lead to a trend reversal or continuation.

Before you head out there and start looking for potential divergences, here are nine cool rules for trading divergences. Divergences act as an early warning system alerting you when the market could reverse. The main advantage of this system is the fact that we have 2 market forces on our side when trading:

Instead of taking trades just based on a divergence signal, you’d wait for the price to move into a previous support/resistance zone and only then look for. The next section is going to describe amibroker afl code for rsi divergence trading system. You can use this indicator in 2 different ways:

It is an age old concept that was developed by charles dow and mentioned in his dow tenets. The technique relies on divergence in numerous method so what we gonna want with this technique two indicator 1) zig zag with depth 50 2) rsi interval 140 the technique is easy and really worthwhile with greater than 75%winratio and 1:2 threat reward ratio purchase setup: Forex divergence trading indicators or trading strategies are one of the most famous indicators 9or strategies in the forex markets.the cause behind this popularity is that divergences are the most significant indicator and may lead up to whichever turns in the price movement.

Using divergence trading can be useful in spotting a weakening trend or reversal in momentum. Check double or triple top/bottom on a chart meanwhile rsi is descending/ascending (check the example on chart) signal line :

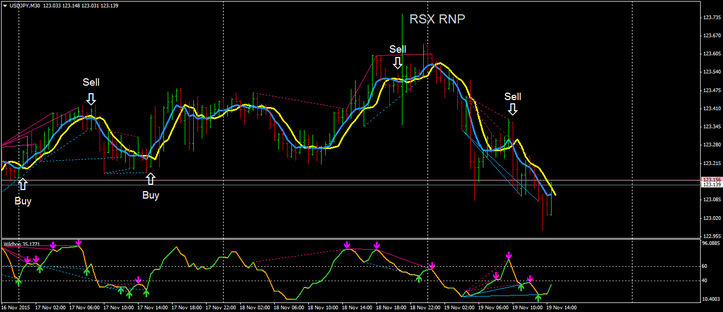

RSX RNP Divergence System Forex Strategies Forex

RSX RNP Divergence System Forex Strategies Forex

Navin Divergence Indicator Mt4

Navin Divergence Indicator Mt4

Stochastic Divergence System The Winnig Strategy with

Stochastic Divergence System The Winnig Strategy with

Forex Divergence Scalping Forex Ea Builder Free

Forex Divergence Scalping Forex Ea Builder Free

The Double divergence A Powerful Trading Concept

The Double divergence A Powerful Trading Concept

Can You Detect Divergence Using The Bollinger Bands

DIVERGENCE (One of the nearly Holy Grail Trading System!!!)

FX5 Divergence Trading System Forex Strategies Forex

FX5 Divergence Trading System Forex Strategies Forex

LST System By Vladimir RibakovAn Automated Divergence

Works on All Time Frame Forex MACD Divergence Trading

Works on All Time Frame Forex MACD Divergence Trading

Adaptive lookback indicators Swing Trades Technical

Adaptive lookback indicators Swing Trades Technical

Binary options divergence strategy, trading system

Binary options divergence strategy, trading system

ระบบเทรด FX5 Divergence Trading System ThaiForexBroker

ระบบเทรด FX5 Divergence Trading System ThaiForexBroker

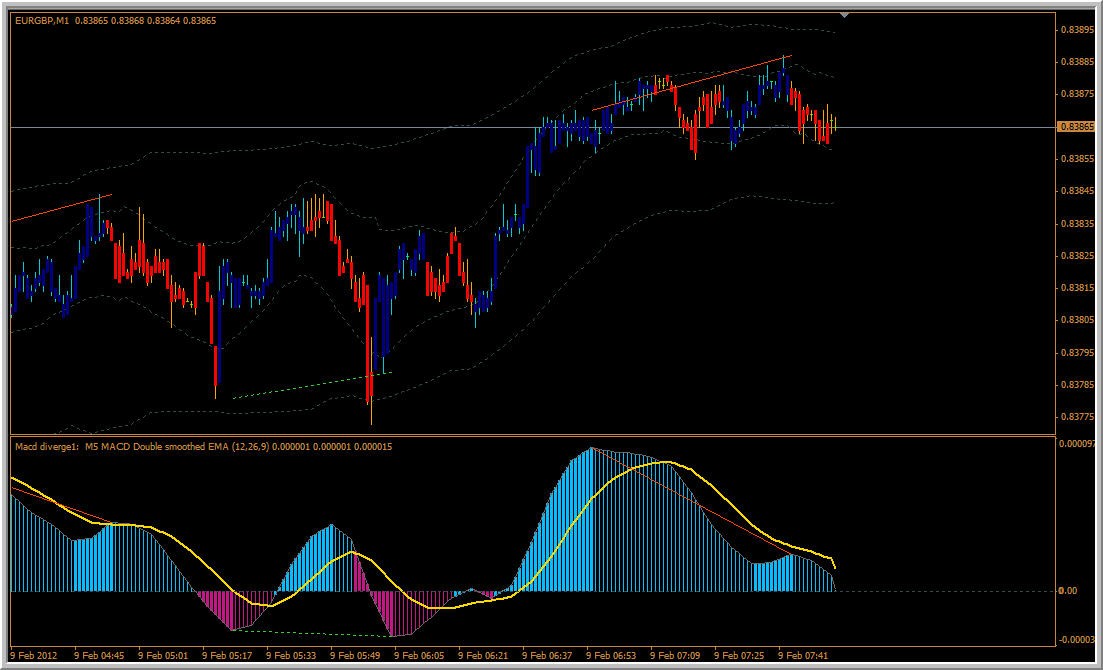

Macd divergence trading system

Macd divergence trading system

FX5 Divergence Trading System Forex Strategies Forex

FX5 Divergence Trading System Forex Strategies Forex

Forex Divergence Strategies Best Free Forex Scalper Ea

Navin Divergence Indicator Mt4

Navin Divergence Indicator Mt4

RSI Divergence Strategy in 2020 (With images) Learn

RSI Divergence Strategy in 2020 (With images) Learn

0 Comments